Asprofin Bank and 360 Wowcom Revolutionize Wellness Tech in Asia-Pacific

Asprofin Bank has partnered with 360 Wowcom to introduce groundbreaking wellness technology solutions

Asprofin Bank is a Dominica-based offshore private bank, founded in 2013, that offers a comprehensive suite of financial services to ultra-high-net-worth individuals (UHNWIs), institutional investors, and fintech partners worldwide.

Clients can maintain accounts in USD, EUR, GBP, CHF, and emerging-market currencies simultaneously

Utilizing both traditional (SWIFT) and fintech-enabled rails, payments are confirmed and settled instantly, even outside normal banking hours

Asprofin Bank empowers clients with seamless global market entry, enabling instant cross-border transactions, multi-currency holdings, and liquidity solutions. Its infrastructure ensures unmatched reach, speed, and reliability in every financial corridor.

Seamlessly bridging traditional finance and digital assets, Asprofin offers custodial crypto services with instant fiat conversion, secure vaulting, and compliance-first protocols, unlocking diversified yield opportunities for ultra-high-net-worth clients worldwide.

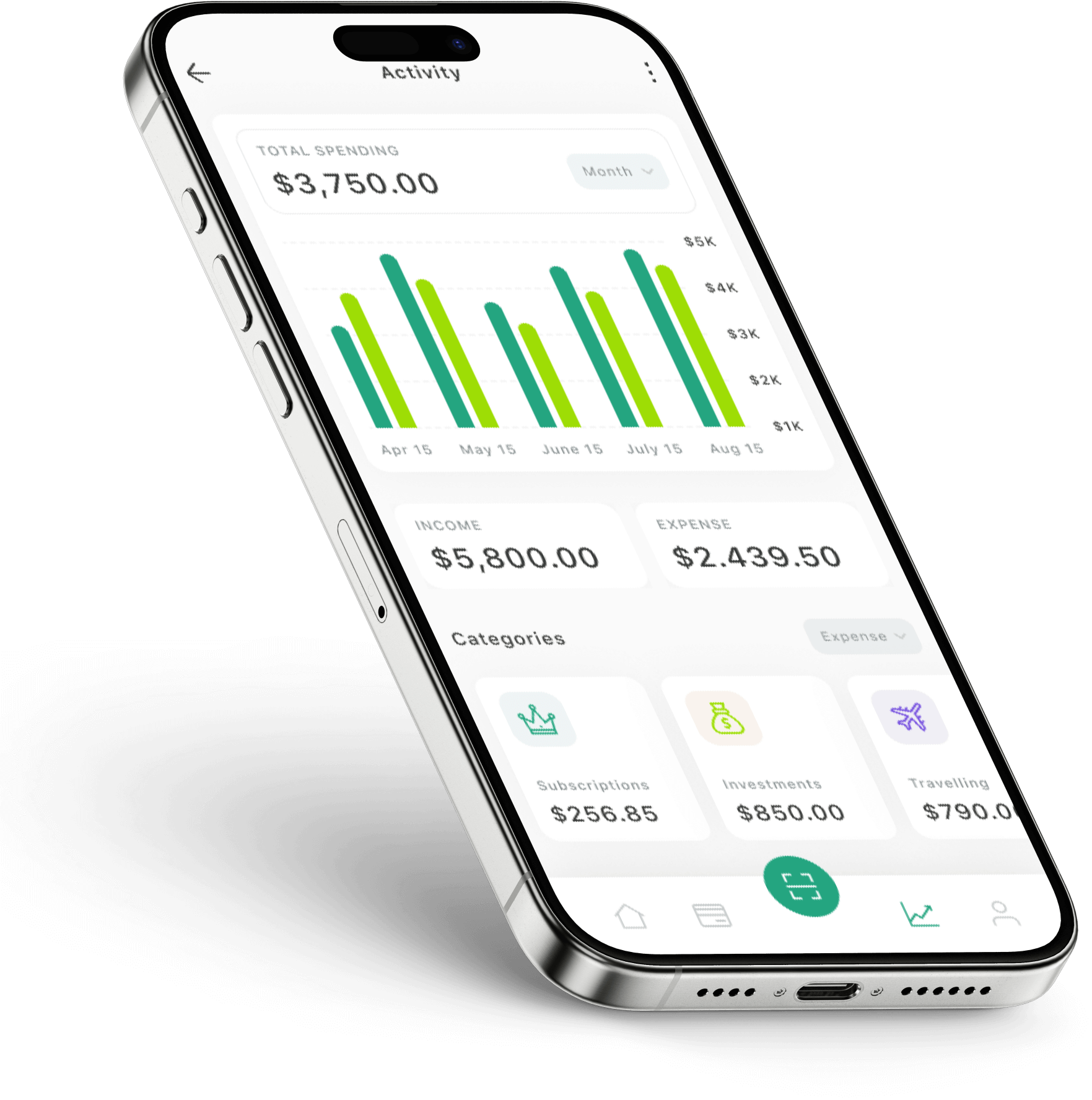

Through high-yield fixed deposits, strategic currency pairing, and real-time market analytics, Asprofin helps clients outperform inflation, enhance capital preservation, and capture institutional-level returns across multiple asset classes and geographies.

Our dedicated team of experts provide comprehensive wealth management, investment advisory, and estate planning services to help you grow, protect, and transfer your wealth with discretion.

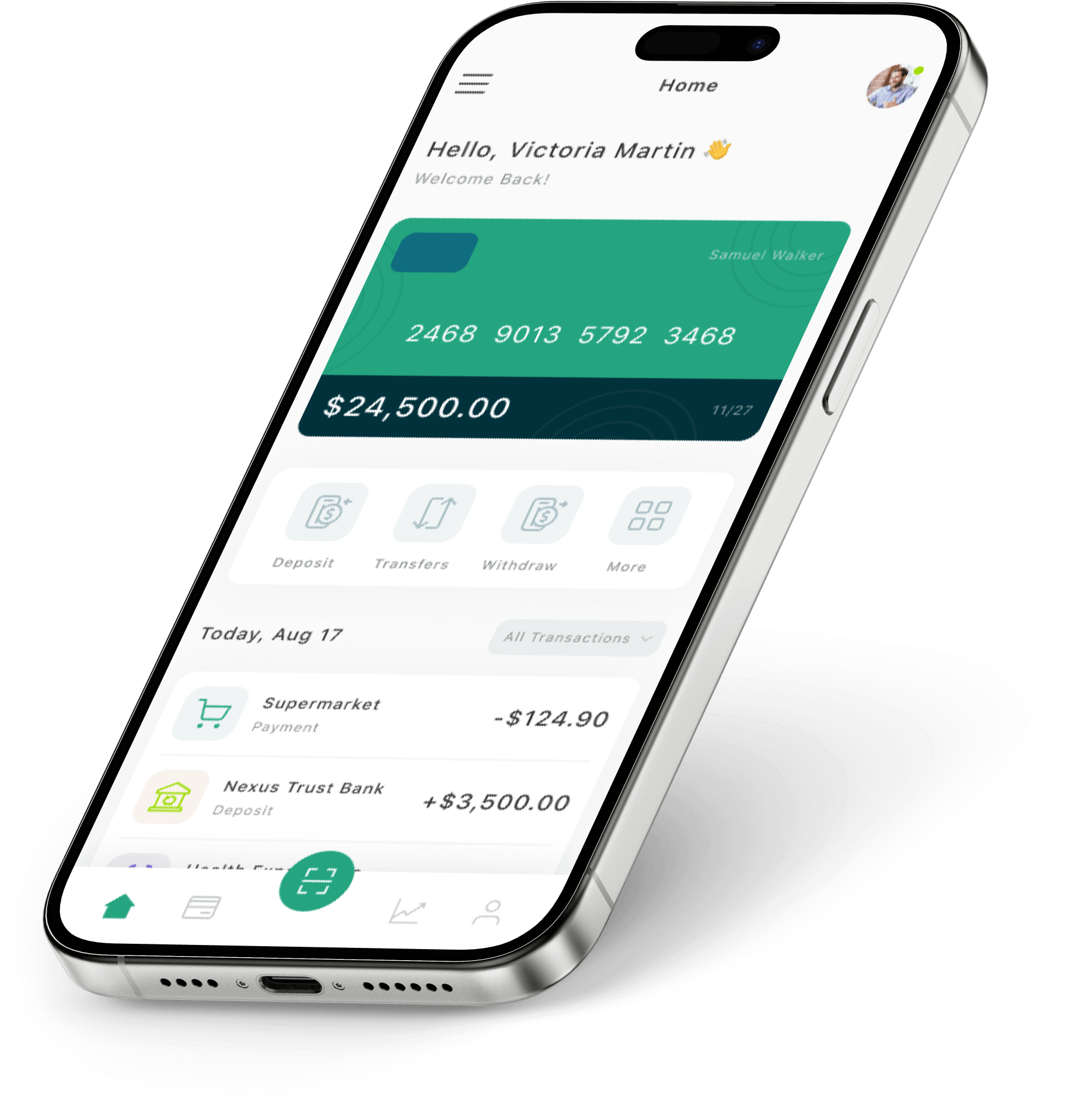

Asprofin delivers tailored personal banking with multi-currency accounts, premium debit facilities, high-yield deposits, and global access, ensuring privacy, liquidity, and elite financial tools for discerning individuals seeking seamless offshore wealth management.

Our business banking suite empowers corporations with instant cross-border settlements, multi-currency cash management, treasury optimization, and strategic credit lines, backed by secure digital platforms and a global correspondent network for operational efficiency.

Asprofin Bank has a proven track record of delivering high-quality financial services to global clients since its establishment in 2013. Our key activities include private banking, wealth management, and financing solutions for high-net-worth individuals and businesses. We have successfully facilitated global development projects by leveraging tailored financial facilities and innovative solutions.

Customized project financing solutions to support global development initiatives, providing capital and expertise to ensure the successful execution of large-scale projects.

For mid-sized companies Expert fund management services, delivering tailored strategies to optimize returns and effectively manage risk across diverse asset classes.to scale

Expert crypto advisory services, guiding clients through the complexities of digital assets and helping them make informed investment decisions in the cryptocurrency market.

Hear from our satisfied clients! At Asprofin Bank, we pride ourselves on delivering exceptional service and personalized financial solutions. Read our client testimonials to see how we’ve helped individuals and businesses achieve their financial goals with trust, expertise, and professionalism. Experience transformative digital banking journeys with Asprofin Bank, revolutionizing financial experiences using advanced technology.

US Private Banker

Asprofin Bank’s professionalism and personalized attention have made a world of difference in managing my finances. Their team has guided me through complex financial decisions with ease, always ensuring that my investments align with my goals. I truly value the trust and peace of mind they provide.

Private Client

Asprofin Bank has been an incredible partner in managing my financial portfolio. Their personalized approach, expert advice, and commitment to my long-term goals have made a significant impact on my wealth management. I trust them completely with my financial future, and their attention to detail and professionalism is unmatched.

Our FAQ section addresses the most common queries about Asprofin’s offshore banking solutions, account setup, security measures, crypto integration, and compliance to help clients make informed and confident financial decisions.

You can open an account by completing our secure online application, providing required identification, and passing compliance checks. Our onboarding team assists every step for a smooth setup.

Yes. Asprofin is licensed under Dominica’s Offshore Banking Act and fully compliant with FATF and CRS standards, ensuring global legitimacy and adherence to strict financial regulations.

Clients can hold multiple currencies, including USD, EUR, GBP, CHF, and selected emerging-market currencies, allowing seamless international transactions without frequent currency conversions or unnecessary FX costs.

Our crypto custody uses multi-signature cold storage, biometric authentication, and insured vaults, ensuring maximum protection for your digital assets while maintaining full regulatory and compliance safeguards.

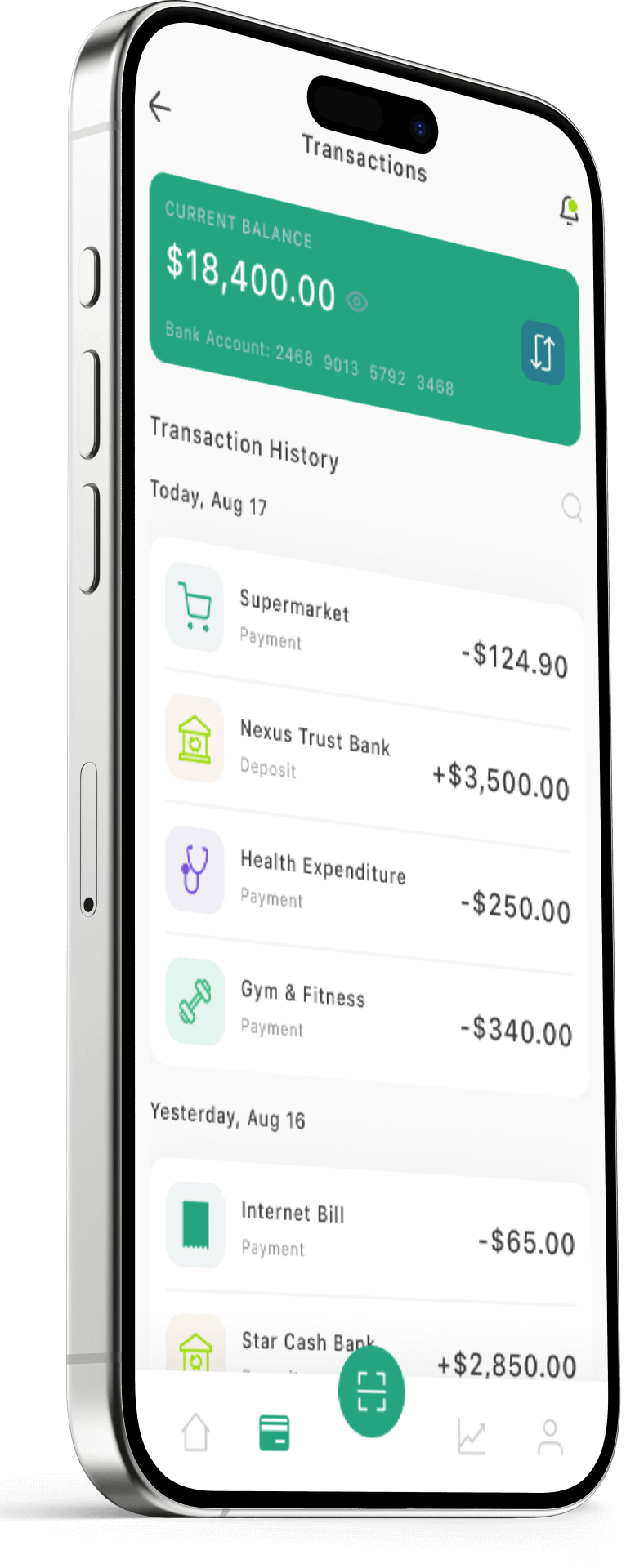

Yes. Our digital banking platform is available 24/7, enabling instant global access to your accounts and transactions from any device, ensuring uninterrupted control over your finances.

Absolutely. We operate under strict anti-money laundering (AML) and know-your-customer (KYC) protocols, adhering to international banking laws to protect clients and maintain the integrity of our financial ecosystem.

Where we navigate the evolving landscape of financial technology, digital banking solutions, and innovative payment systems.

Asprofin Bank has partnered with 360 Wowcom to introduce groundbreaking wellness technology solutions

In an age where connectivity is essential, Asprofin Bank and 360 Wowcom are